Q2 2024 Dubai Residential Real Estate Market Report

As the Dubai real estate market continues its upward trend, fueled by significant growth over the last few years, we have started to see a shift in the market which is not only evident in the various data sets but also in daily real estate activities across the streets of Dubai.

Market Evolution Amid Growth and Shifting Dynamics

Following the post-COVID surge in record-breaking transactions and an influx of foreign investors driven by geopolitical factors and Dubai's tax-free, investor-friendly environment, the real estate market is now slowly showing signs of realigning with market norms rather than the anomalies in demand seen in previous years.

While the market continues to grow month-on-month, it is beginning to slow down, a trend likely to continue over the next year. This shift will be further influenced by multiple underlying factors, such as new supply entering the market and sellers adjusting their asking prices as they realize their properties are not worth the inflated values of previous years. These inflated prices were driven by low supply in some areas and segments and high demand, which has now dissipated.

Comprehensive Market Analysis: Beyond Sales Transaction Data

When analyzing the real estate market, it is important to note that while sales transaction data forms the basis of market analysis, it does not fully capture immediate market shifts and trends due to a lag in real-time market conditions.

Once a deal is agreed upon, it must go through a comprehensive transaction process that can take 3-4 months to complete. This is true for ready/secondary market transactions and off-plan transaction registrations. Subsequently, the data needs to be analyzed and reported, adding further time to the timeline. Therefore, other data sets such as listing data, supply data, demand data, mortgage data, and off-plan developer data need to be analyzed in parallel to gain a more accurate and timely understanding of market dynamics.

Early Indicators of Market Shift and Transaction Trends

Examining the property listing data reveals one of the first indicators of a market shift that began at the end of last year. According to REIDIN, a UAE real estate data platform, since September 2023, the median residential listing price value started to decline month-on-month by an average of 5%. This was the first sign that the market was transitioning from a seller’s market to a buyer’s market, a reality we are now seeing. Another indicator was the average days on market for a residential sale listing, which has increased from a strong 30 days last year to over 90 days today, indicating a more stagnant residential sales listing market as of Q2 2024.

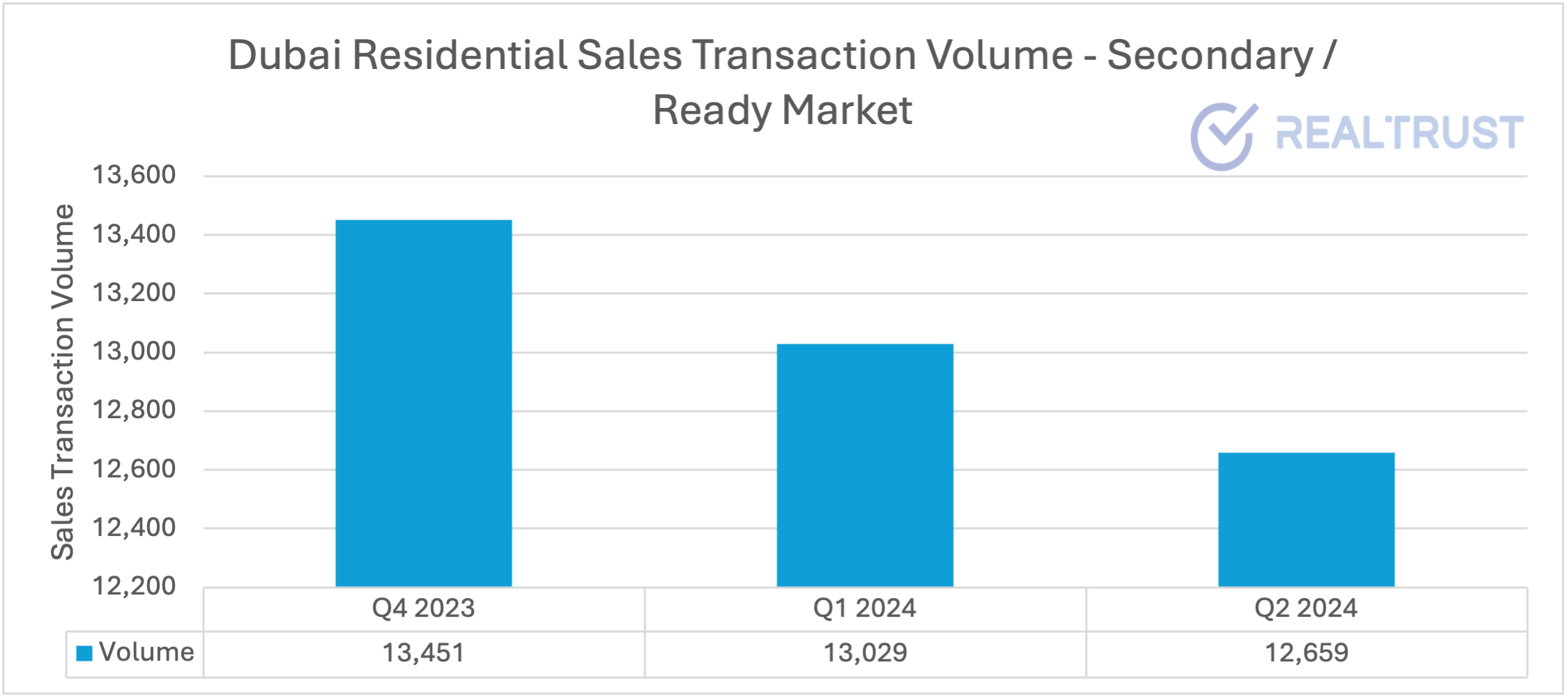

This trend in the listing data is now starting to reflect in the transaction data. According to Dubai Land Department open data, in Q2, we saw a 2.9% decline quarter-on-quarter in the secondary/ready market residential sales transaction volume. This marks the second consecutive quarter of decline in this segment. However, the median sales price for residential secondary transactions in Q2 was AED 1.4M, showing a substantiated and steady 5% increase from Q1.

Looking more closely at Q2 Dubai real estate market performance, we observed a total of 40,936 sales transactions worth 118 billion dirhams, marking a 10% increase quarter-on-quarter and a 36% increase year-on-year in overall sales transaction volume across all segments. In the breakdown, 65% or 26,642 sales transactions were for off-plan, while 35% or 14,294 sales transactions, were in the secondary/ready market.

When looking specifically at the residential sales market, the top areas for residential sales in Q2 were Jumeirah Village Circle, Business Bay, Meydan One and Dubai Hills Estate. It is also interesting to note that 59% of total secondary residential sales transactions were mortgaged in Q2, which is a healthy sign for a mature market, indicating that end-users and residents are purchasing properties for owner occupation.

Impact of Off-Plan Property Launches on Market Dynamics

The significant increase in off-plan property launches and completions will play a major role in shaping the Dubai real estate market's future, as these developments are expected to have a substantial impact in the upcoming years. In 2023, 107,145 new residential units were launched in Dubai, and in 2024, we have seen 78,361 new units launched thus far.

These figures are clearly reflected in the off-plan sales transaction data for Q2, with an 18% increase quarter-on-quarter and a 64% increase year-on-year in off-plan sales.

However, it is important to note that while sales volumes are increasing, the median off-plan sales price in Q2 was AED 1.54M, representing a marginal 0.6% decline from Q1 and the second consecutive quarter decline in off-plan median sales price.

Current Developer Strategies Shaping Market Dynamics

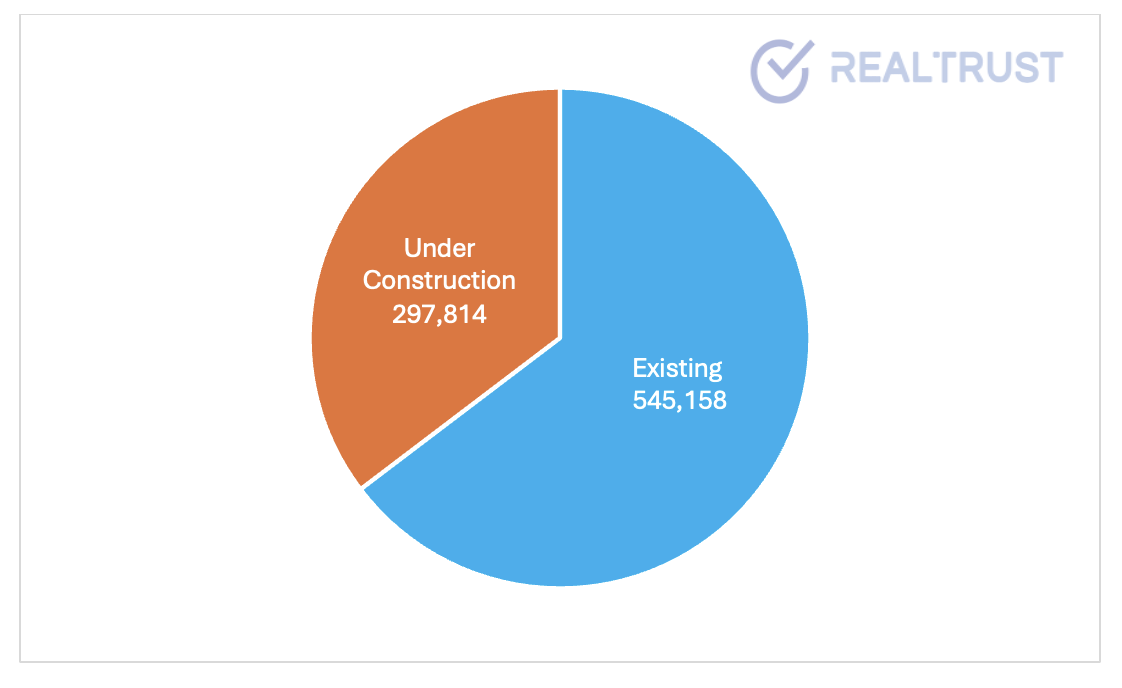

According to REIDIN, today there are 297,814 residential units under construction in Dubai, which is 55% of the total existing residential supply that currently stands at 545,158 units.

Signs of a shift are already evident in the off-plan segment as developers offer more competitive products through incentives, discounts, and extended post-handover payment plans. Of the newly launched projects this year, 34% feature post-handover payment plans, ranging from 12 months to 120 months. Of these projects, 27% offer 24-month post-handover payment plans and 23% offer 36-month plans. The top developers providing these extended post-handover payment plans are Emaar and Danube. This substantial pipeline of new units and competitive developer strategies is set to significantly influence the market dynamics in the coming years.

Impact of Off-Plan Sellers and Future Supply on Market Dynamics

Additionally, individual sellers in these off-plan projects are struggling to sell at opening prices (OP) which is the prices they originally bought for, or below, to avoid the next developer payment they cannot afford, opting to take a loss instead of the premiums they were promised when they originally purchased at the peak of the market in 2022 and 2023. This has been a common scenario over the last few months and likely to increase over the coming quarters and years as a significant amount of off-plan supply begins to transition in the pipeline.

This year, a little over 52,000 units are expected to be completed, although the actual number of handovers may vary due to construction delays and other factors. In 2025, we expect a little over 71,000 new units to be completed, and over 110,000 newly completed units in 2026. The top three areas for new residential units over the next few years will be Jumeirah Village Circle, Business Bay, and Dubai South. The leading developers with projects under construction are Emaar, Nakheel, and Damac.

Future Supply Influx and Its Impact on Market Dynamics

This influx of housing supply will likely impact market positioning and alter the dynamics of supply and demand. Consequently, we can expect changes in prices within both the sales and rental markets as they pivot in a new direction over the next few years. Areas such as Jumeirah Village Circle, where demand is very high and supply is very low, have seen prices more than double over the years. However, there is potential for balance as approximately 30,000 new residential units, representing 80% of JVC’s current housing stock, are expected to enter the market in the coming years.

Business Bay, another high-demand area with low supply and skyrocketing prices, will see approximately 20,000 new residential units enter the market. Additionally, Dubai South, a more recent popular hotspot due to the newly announced airport, will have 14,000 new residential units added over the next few years.

Q2 Rental Market Performance

In Q2, the Dubai rental market saw a total of 139,617 EJARI rental registrations, reflecting a 13% decline from Q1 and a 5.5% increase year-on-year. Breaking it down further, 65% (90,314 contracts) were renewals, while 35% (49,303 contracts) were new rentals.

The median rental price for contract renewals increased by 4% increase from Q1 and new contracts median rental price increased by 8% from Q1. The top areas for overall rentals in Dubai during Q2 were International City, Jumeirah Village Circle, Dubai Silicon Oasis, Business Bay, and Discovery Gardens. For villa rentals, the leading areas were Mirdif, Damac Hills 2, Town Square, Springs, and Dubai Hills Estate.

Macroeconomic Factors and Population Growth

When considering the macroeconomic picture, several key points emerge. In June, the Central Bank of the UAE (CBUAE) lowered its inflation forecast for 2024 from 2.5% to 2.3%, predicting the same rate for 2025, due to domestic demand and potential dirham depreciation. Dubai’s Q1 2024 inflation averaged 3.4%, rising to 3.9% in April due to increased transport costs and housing prices.

Globally, uncertainties persist, with slower growth expected in the US and China, which could have mixed implications for the UAE economy. However, changes in interest rates may affect the dirham, helping to mitigate UAE inflation. This past week, the US reported a decrease in the price of everyday goods and services for the first time in four years since the pandemic, which, along with a rising unemployment rate for three consecutive months, could help curb inflation in the US. These various factors could lead to a possible US Fed rate cut in September, which would have an immediate effect on interest rates in the UAE.

Additionally, Dubai’s population continues to grow steadily, with 25,776 new residents in Q1 2024, bringing the total population to 3,680,785. This growth is consistent with the trend of averaging 100,000 new residents annually since COVID.

Conclusion: Navigating the Future of Dubai's Real Estate Market

In summary, the Dubai real estate market is experiencing a gradual shift after several years of exponential growth. While the market continues to expand, indicators such as a readjustment in demand, declining residential sales listing prices, increased days on market, and a slowing residential sales transaction volume suggest a move towards a more balanced state. The introduction of a substantial number of off-plan properties and competitive developer strategies will shape part of the market's future. As these changes unfold, both the sales and rental markets are expected to adjust, impacting prices, supply and demand patterns.

The overall economic environment, both locally and globally, will play a critical role in determining the trajectory of Dubai's real estate market. Factors such as geopolitical tensions, changes in global economic conditions, possible interest rate cuts, population growth and investor sentiment will influence the market's direction. Consequently, it is essential for stakeholders to stay informed and adaptable to navigate the evolving landscape successfully.

The data doesn't have an opinion; it simply reflects the current state of the market. Therefore, when examining the real estate market, being equipped with the right data and various data points is crucial to making educated and informed decisions.

Lynnette Sacchetto is regarded as an authority and influential voice in Dubai's real estate sector, with an 18-year track record of specialization in Dubai’s PropTech industry. She is the Founder of RealTrust, a one-stop full service real estate solution in Dubai.